Want to get straight at it and know my #1 recommendation for the best credit building apps? Go with Grow Credit Builder and CreditStrong.

It is necessary to have a credit building app when you are just starting out and need to build your credit score.

This is because it takes time to establish a good credit score. Building your credit score requires that you pay your bills on time and maintain a low balance on your credit card.

Credit building apps are a new way to help people with poor credit access credit. They work by helping you build a better credit score, which will make it easier to get approved for loans and credit cards.

There are a few different ways that these apps can help you with your credit score and we will be looking at them in detail in the sections below:

Money cannot buy happiness, but it can procure some of the happiness in this life. Earn revenue by clicking the link below.

What Are The Best Credit Building Apps?

Here Are The Best Credit Builder Apps For This Year.

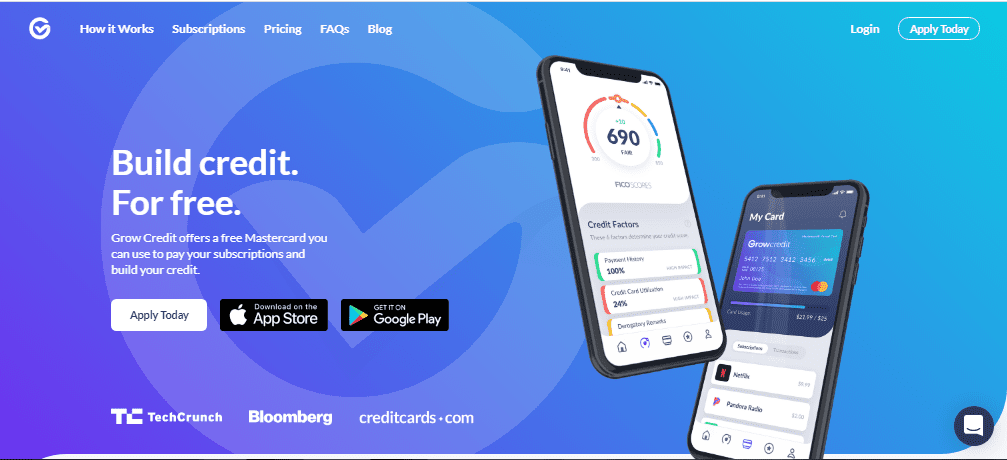

1.Grow Credit Builder.

Grow Credit Builder is dedicated to offering free virtual MasterCard to help pay subscriptions and builder credit.

The card can then be used to pay for recurring subscriptions like Amazon Prime, Netflix, Spotify, and Hulu.

They also report your monthly repayments to three credit bureaus to help you build your credit repayment history.

How Does Grow Credit Work?

1.Create your account.

This is super easy to do and you need to just apply for a Grow credit builder interest-free Mastercard and connect your bank account.

2.Add subscriptions.

Your next step is to add subscriptions to your Grow credit builder.

3.Use your new Grow credit builder Mastercard as your payment method.

It’s time to add your card number to your new and existing subscription accounts and get paid consistently with your new Grow credit builder Mastercard.

4.You are all set up to see your credit grow.

Now this is the cool part as your subscriptions will be paid with your new card and your payments will be consistently made which contributes to a better credit score.

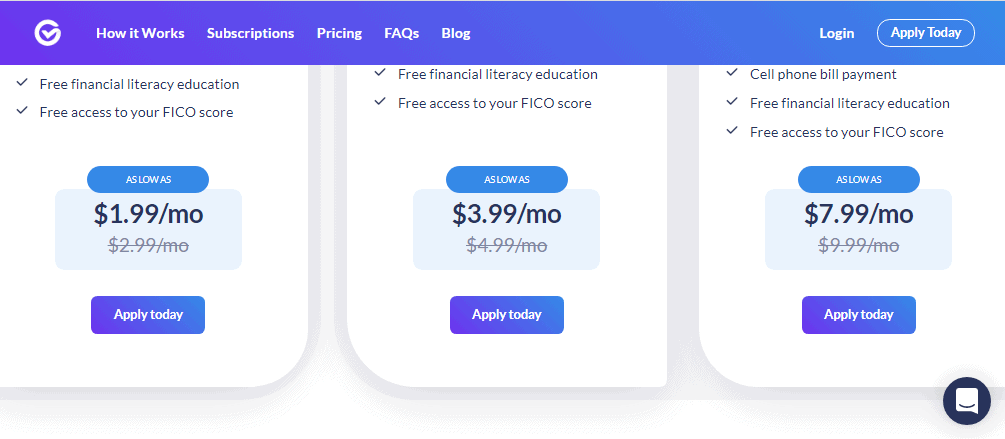

Grow Credit Builder Pricing Plans.

There are 4 pricing plans in here and will go over them below:

· Build Plan.

· Build Secured Plan.

· Grow Membership Plan.

· Accelerate Plan.

Build Plan:

This Build plan is free and there is no monthly fee or annual fees, and there is no obligation to upgrade to Build Secured Plan at any time.

Build Secured Plan:

The Build Secured plan is best for customers who do not meet the Build underwriting criteria and it goes for $1.99 monthly fee.

This Build Secured plan offers you an Annual Limit of $204 and a Monthly Spending Limit of $17 to help improve your credit score significantly.

Grow Membership Plan:

Grow membership plan goes for $4.99 monthly fee.

This Grow membership plan offers you an Annual Limit of $600 and a Monthly Spending Limit of $50.

Accelerate Plan:

Accelerate membership plan costs $9.99 monthly fee.

This Accelerate membership plan offers you an Annual Limit of $1,800 and a Monthly Spending Limit of $150 to help improve your credit score significantly.

NOTE: Grow and Accelerate memberships provide higher monthly transaction limits and can lead to a greater impact on your credit score and make you credit strong.

2.CreditStrong.

CreditStrong is the fusion of a secured consumer installment loan and savings account. This credit building account is going to help you build both credit history and savings.

How Does CreditStrong Work?

1. You will need to create a credit building account here to have access to an installment loan from Austin Capital Bank.

2. When you make a payment, the principal portion of your loan payment is credited towards the lock on your savings account and the interest portion of your payment is how they cover the costs of providing the service to you.

3. During the term of your credit building account, they report your loan payment history to all major three credit bureaus and you earn interest on your savings account balance.

4. When the loan is paid in-full, the lock is removed from the savings account and the funds become available to you.

CreditStrong Pricing.

There are 3 pricing plans inside this CreditStrong credit building app and I will go over them below:

· Revolv.

· Instal.

· Magnum.

Revolv.

Revolv plan charges annual fees of $99. With this package you can instantly build $500 of revolving credit, improve your credit mix, build payment history, optimize your utilization, build savings and get a FICO Score monthly for free.

Revolv accounts can positively impact factors that determine 90% of your FICO® Score.

Instal.

Instal charges monthly subscription fee of $15. With this price plan you will get $1,000 installment account reported, lowest cost Instal account available, build up to 120 months of payment history and you can cancel anytime with no penalty.

Instal accounts can impact factors that determine 90% of your FICO Score.

Magnum.

Magnum goes for $55 monthly. Magnum accounts are built for those who have money and need credit. It’s actually not for everyone.

Infact its best suited for you if you want to apply for a larger personal loan, apply for credit cards with higher credit limits, want to maximize your credit profile and not just your score, if you are a sole prop business owner without an EIN and want to build personal credit for business purposes using your SSN.

3.Sable.

Sable is one of the best credit boosting apps for building your credit faster.

Sable has teamed up with Member FDIC, Y Combinator and Coastal Community Bank to grow a community of 100,000+ users on a journey of building or rebuilding their financial future.

They make credit and debit quick to get, banking easy to understand and credit score fast to build.

And they report your credit history to major three credit bureaus to ensure you build your credit as fast as possible.

Also, you get real time credit history and make every purchase count towards building your credit.

How Does Sable Work?

Here is how this credit building app works:

1. Download The App.

You will need to download the Sable mobile app & create an account in 5 minutes with your passport and U.S. visa for document verification or an SSN if you have one.

2. Set Up Your Sable Account.

To do this, you will need to add money to your Sable account, set your credit limit by locking some of the money on your Sable account, begin to use your Sable virtual card immediately by adding it to ApplePay®, GooglePay® or Samsung Pay® while they mail you your physical card in 5-7 working days or business days.

3. Build Your Credit.

Start to pay for things with your Sable credit card by using the money in your account to pay for your secured credit card bill.

And see your credit history grow as you transact.

4.SeedFi’s Credit Builder Prime.

SeedFi’s credit builder prime is a credit building platform that offers plans to help you build credit, save, and get immediate cash at responsible interest rates.

They aim at helping you grow your money, no matter where you are starting from.

Their products are well designed to help improve your financial future by leaving you with savings that you can use instead of borrowing, a feature that is not common with many credit builder apps. This goes a long way to save you from pitfalls that can come with high cost loans, and free you from worrying about payment and delinquencies.

How Does SeedFi Work?

There are 3 steps by which SeedFi works .and I will explain below:

Step 1.

SeedFi adds small interest-free loan to your locked savings account every pay period. You will need to select the amount and they will add as little as $10.

Step 2.

you will need to repay SeedFi for the small interest free loan they gave you in Step 1 the next time you get paid. Doing this will help you build your credit.

Step 3.

From this point, every time you save $500, they will give you access to it. Repeat the same steps and keep your plan active to maximize impact.

5.Credit Sesame.

Credit Sesame is one of the best credit builder apps that has a mission of empowering people to take charge of their credit and loans and achieve their financial goals.

They offer better credit facilities by helping people to effectively manage their credit and cash and they do this base on their deep credit expertise and understanding of the relationship between cash and credit.

When you create a free account with them, you get the benefits of bank-level analytics developed with scientists from UC Berkeley and Stanford which is not common with many credit builder apps.

How Does Credit Sesame Work?

There are 4 steps by which the Credit Sesame credit builder works and I am going to explain below:

Step 1.

You will need to claim your no-fee Sesame Cash debit card and add money to your credit building account.

Step 2.

You need to turn on credit builder to allocate part of your balance as a security deposit for a virtual line of credit.

Step 3.

You will need to use Sesame Cash debit. Doing this will allow them to add the purchases to your line of credit each month and pay the balance on-time.

Step 4.

Now you are all set up and you just need to allow them to update the three major credit bureaus to build a good credit history each month.

Disclosure: If you decide to purchase a paid plan, I might even get cash for some of the links on this webpage at no extra charge to you. However, the items and services I recommend are all those that I have actually tried and found to be the finest.

You’ll be delighted you did if you click on the link below.

Try My #1 Recommended Program >>.

What Are The Free Features Of Credit Sesame?

Credit sesame has the following free features:

· Identity Theft Protection.

· Credit Monitoring and Alerts.

· Mobile Apps.

Identity Theft Protection.

With this free feature you get $50,000 in identity theft insurance, plus fraud resolution assistance in the event you’re ever a victim of identity theft.

Credit Monitoring and Alerts.

This feature monitors your credit report at no cost and sends you monitoring alerts about changes to your credit report.

Mobile Apps.

This is a better way to stay on top of your finances no matter where you are. With this feature, you can access your Credit Sesame account on your desktop and through mobile apps on your iPhone or Android.

6.Self’s Credit Builder Loan.

Self is one awesome app that offer good credit as it focuses on what you aspire toward. Whether it’s being a Car Builder, Home Builder, a Queen Builder, a Life Builder and helps you make it possible.

And they have the best self-credit builder loan that can get you access to the Self Visa secured credit card in as little as 3 months with no hard pull on your credit.

How Does Self Credit Building App Work?

The way this Self credit building app works is super easy and I will explain below:

1.You will need to apply for a the Self Credit Builder Account.

2.Start to pay off your Credit Builder in the specified amount of time to achieve a good credit score by choosing the payment term and dollar amount that best fits your budget.

3.Your monthly payments are reported to all three major credit bureaus to build your credit history and add to your savings.

4.After paying off your credit builder account you will achieve a good credit score, your CD unlocks and the money is yours (minus fees and interest).

What Are Some Of The Features Of Self’s Credit Builder Loan?

1.There is no hard pull on your secured credit card when you apply for a Self Builder Account.

2.You get to automate payments help you stay on track without worrying about due dates.

3.You can track your secured credit card score by watching how your score changes over time – at no extra cost.

4.Every payment is reported to all three major credit bureaus.

5.You have the choice to cancel anytime and get your savings progress back, minus interest and fees.

Self Pricing Plans.

This best credit builder loan has 4 pricing packs in here and they are as follows:

· Small Builder.

· Medium Builder.

· Large Builder.

· X-Large Builder.

Small Builder.

Small Builder charges monthly subscription fee of $25 for 24 month and you will get back $520.

Medium Builder.

Medium Builder charges monthly payment of $35 for 24 month and you will get back $724.

Large Builder.

Large Builder charges monthly payment of $48 monthly for 12 month and you will get back $539.

X-Large Builder.

X-Large Builder is going for $150 monthly for 12 month and you will get back $1,663.

Try Self's Credit Builder Loan.

7.Extra.

Extra is in to create a more accessible credit experience with the ease and predictability of a debit card.

They offer good credit to help you relax, work towards your long-term goals and avoid the pitfalls and traps of a secured credit card.

At the end of the month, they will add up all of your purchases to build positive payment history and report them to both Equifax® and Experian® as credit-worthy payments.

How Does Extra Work?

The way Extra works is super easy and I will explain below:

1. Sign up by connecting your bank account, and they will give you a spending limit based on your bank balance and other factors with no credit check.

2. Swipe your Extra Card, and they will spot you for that purchase and pay back the next business day.

Extra Pricing Plans.

Extra charges a flat monthly subscription instead that ranges from $8 per month to $12 per month.

What Are Credit Building Apps?

Credit building apps are designed to help users build credit. They usually offer a credit card and a checking account. Users can use the card to make purchases or take out loans, with the money being deposited in the checking account.

Credit building apps are designed to help people who have no credit history build their credit score. They usually offer a credit card and a checking account for users to use when making purchases or taking out loans.

FAQ On Best Credit Building Apps.

Here, I will be answering the frequently asked question on credit building apps.

What Is Common With The Best Credit Building Apps?

A good credit building app should be able to help you in many ways. For example, it can help you by showing you what your credit score is, what your risk level is, and how much of a risk you are to lenders. It can also show you the different ways that you can improve your credit score.

The best credit building apps are the ones that have features such as:

· Analyzing your spending habits and showing you where they might be costing you money.

· Helping with budgeting so that it doesn’t take up all of your time.

· Providing tips on how to get out of debt.

What Is A Credit Score When It Comes To Credit Building Apps?

A credit score is number that is a calculated by a credit bureau to represent the likelihood that you will repay a loan. The higher your credit score, the more likely you are to repay your loans and the less likely you are to default.

There are many different types of credit scores and it’s important to know what type of credit score is being used when working with any type of credit building app. Your FICO score is one type of credit score that banks use in lending decisions and it’s usually considered the most important type of credit score for consumers.

What Are The Major Components Of A Credit Score?

The three major components of a credit score are:

1) Payment history- how well you have paid your bills in the past.

2) Amounts owed- how much money you still owe.

3) Length of credit history- how long you have had your current accounts open.

What Are Credit Bureaus?

Credit bureaus are organizations which keep records of a person’s history. These credit reports include their payment history, the number of times they have applied for credit, and any inquiries into their credit.

Credit bureaus or credit reporting bureaus make money by charging customers who want to access this information. They also charge companies who want to use this information to decide whether or not they should give someone a loan.

What Are The Disadvantages Of Having Bad Credit Scores?

Bad credit scores can put a person in a position of disadvantage. They may not be able to buy a home, get approved for loans, or even get hired for a job.

Some of the disadvantages of having bad credit scores include:

· When people have bad credits scores they are more likely to be denied at the bank when they apply for loans.

· People with bad credit scores may have higher interest rates on their credit cards and other loan interests.

· It may be difficult to find an apartment or house that will approve them as tenants due to their bad credit score.

How Does One Go About Improving Their Credit Score?

There are several ways in which you can improve your credit score, some of which are listed below:

· Check your credit reports for errors and make a list of any changes that need to be made.

· Make sure you have a good payment history.

· Check your credit card usage and make sure you are not overspending.

· Check your borrowing history and make sure you have not missed payments on loans or borrowed too much in the past.

What Is Credit Builder Loan?

Credit builder loan is a short-term loan that can help you build your credit and establish a good credit score. These types of credit builder loans can be used for anything from purchasing furniture, to building a new home, or even starting a business. Credit builders typically have low interest rates and flexible repayment terms, meaning they’re easier to manage than other types of debt.

Is It Advisable To Go For A Credit Builder Loan?

This is a question that has been asked by many people who want to take out a credit builder loan. The answer is yes, but there are some things you should know before you decide to go for it.

First and foremost, think about the purpose of the loan. If you’re looking for something long term, this isn’t the best option for you because it will take a lot of time and effort to build up your credit score and get into long-term financing options like mortgages and car loans.

What Are The Best Strategies To Start Building Credit With Credit Builder Apps?

Credit builder apps are helpful in building credit and also help you to get rewards for your efforts.

The most important thing that you need to do is to make sure that you have a better credit score before you start using these apps. Also, it is important to know what type of credit builder app you need, so that you can choose the one that works best for your lifestyle.

Some of the best strategies to apply when building credit are:

· Make sure that your credit score is high enough.

· Keep a low balance on all of your cards.

· Pay off any outstanding balances.

· Track how much money you spend per month and try not to exceed this amount.

What Is Credit Limit?

Credit limits are generally used in finance to determine how much debt a person or company can handle before they are unable to repay their debt. In other words, credit limit is the maximum amount of borrowing that someone is allowed to take out from a lender.

What Is Credit Monitoring Service?

Credit monitoring service is a type of service that offers to monitor your credit history, credit score, and credit reports. It can help you avoid identity theft and financial fraud.

Credit monitoring services provide a variety of services such as:

· Monitoring your personal information in the event it gets stolen or compromised.

· Monitoring your current account activity in order to prevent unauthorized activity from occurring on them.

· Monitoring your current account activity in order to avoid overdrafts or other fees.

· Checking for any fraudulent charges on your accounts.

· Checking for any changes in the status of your accounts.

What Is Credit Utilization Ratio?

It is a measure of how much debt a person has compared to their total available credit. It can be calculated by dividing the total outstanding balance on all cards by the total available credit.

What Is A Credit Builder Card?

A credit builder card is a card that provides consumers with a temporary credit line to buy goods and services. These cards are usually issued by banks, lending institutions, and retailers.

What Is A Credit Report?

A credit report is a summary of your financial history. It includes information about your credit histories, payment history, and debt repayment. It is used by lenders to determine whether or not you are eligible for loans or other kinds of financing in the future.

What Are Fico Scores?

FICO scores are a type of credit score that is used by lenders to assess the risk of lending money or providing credit.

What Is Poor Credit Score When Using Credit Building App?

Poor credit score is a term used to describe a credit score that is below the median. This can be due to a lack of payment history, late payments, or defaults.

What Is Credit Utilization?

Credit utilization is an important metric for lenders, as it helps them to determine whether or not they should approve a loan. It can also help borrowers to understand how much money they have left to spend on other things in their budget.

Is There A Monthly Service Fee For Using A Credit Builder App?

There are many different types of credit builder app, and you’ll want to compare the different features offered by each one. Some offer low monthly fees, while others have higher fees but more generous terms.

What Is An Experian Credit Report?

Experian Credit Report is a report that is used by lenders to determine the risk of a borrower or potential borrower. The report is compiled from information collected from various sources such as the following:

· Personal identification number.

· Credit card statements.

· Bank statements.

· Utility bills.

· Insurance policies.

· Social security numbers.

Executive Summery On Best Credit Building Apps.

Credit building apps are now available on the market to boost your credit score, and they have been getting more popular among the younger generation.

Change must not be feared. If you want to see an improvement in your life, you should change the way you do things.

Are you ready to take the next step and progress to the next level? Please visit the link below.

Try My #1 Recommended Program >>.

You should be mindful of your spending habits and how the app works. It is important to understand that the app does not give you a free pass on spending money, but instead helps you save money in different ways.

Credit building apps will be helpful for you if you want to boost your credit score up without needing to spend a lot of money in order to do so. They can also help with managing your debt and improving your financial situation as well as establish some good habits that can lead to financial success in the future if you take advantage of them.

RECAP: My #1 recommended credit builder tool is Grow Credit Builder.

Which credit building app have you tried before or plan on using?

Kindly let me hear your views in the comment box below. Thanks.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.